By Ben Langlotz

|

July 10, 2019

|

Firearms

|

0 Comments

MORE NRA… plus How Inventors Can Cut Patent Costs

Why Even I Shouldn’t be an NRA Director

The above was going to be my newsletter title, but we’ll get back to business after a couple of months of NRA Snafu news. Here’s a quick update:

- The reason I shouldn’t be a Director is probably exaggerated, but being a Director is good for business and PR in this industry, and it would benefit me. That’s not who you want for directors. We’ll get into it later, but Directors should care only about ensuring good corporate governance, and not how decisions affect their personal bottom line.

- Last month’s news I broke about the NRA’s law firm being owned by Hillary and Beto donors was picked up by some other outlets, and I’m glad to help the effort to ask who is making big money decisions and why. I still have no idea how I got the idea to check out the political donations of that firm – I haven’t researched anyone that way for years.

- I closed last month’s news with a very gentle call to action: “talk to your peers about the NRA situation.” Let me modify that now in light of the recent firings and resignations – with no sign that Wayne realizes his time is up. If you’re an NRA advertiser or an Annual Meeting exhibitor, you’re writing the NRA big checks. So I’m now asking you to publicly or privately contact at least one current NRA Directors and tell them what you think they should do, and why they should care what you think.

Now, back to business. It’s about “Micro-Entity” patent fees.

Several years ago I wrote “Beware of Congressmen Bearing Gifts” when a reduced patent fee law was enacted. With five years under our belt, I wanted to revisit the issue. This topic is mostly for startups and solos, but might still be of interest to others.

The good news is that you might qualify for reduced patent fees under new patent laws, thanks to a “gift” from Congress to small inventors.

The bad news is that it might be too risky to enjoy the benefit. But maybe not as bad as I feared.

In a big change in the patent laws five years ago, Congress created a “Micro Entity” status that provides reduced fees for the smallest inventors and start-up companies. Before, there were “Large Entities” (big companies with over 500 employees) and “Small Entities” (just about everybody reading this newsletter). Patent fees for Small Entities have long been half price compared to the fees the big corporations pay.

Half Price Can Be Awfully Tempting

Now, we have “Micro Entities” which pay half of the Small Entity fees.

What’s a Micro Entity?

Count on Congress to be sure that’s a difficult question to answer, and that getting the answer wrong (taking the discount when you weren’t entitled) can be potentially painful (you risk your patent rights).

Micro Entity status is reserved for applicants who don’t have too much income, or too much patent experience. (Also for employees of higher education institutions, but that’s probably not pertinent here).

The income threshold is $184,116 per year, and the threshold changes every year because it’s based on three times the national median household income. This figure presumably always rises due to inflation and economic prosperity, but you never know.

It relates to the income in the prior tax year to the patent filing, so if everyone had an off year that can be good news for patent costs.

It applies to each co-inventor and the “applicant” (which could be a company) and the “assignee” or “licensee”, so if you’re collecting royalties from a company making a decent income, don’t bother.

The Unanswerable Questions

If you’re close to the threshold, beware. (Actually, if you’re close, just fuggedaboudit, if you know what’s good for you).

As I recall from a tax law class in law school, the key question usually is: “What is income?” (I did quite well in the class, but I’m sure glad I didn’t become a tax lawyer). In this case, “income” is individual gross income, excluding the income of others in the household. This would normally mean salary from all jobs, investment income, and profits distributed from your business (and the scary thing Congress did is to force non-tax specialists like me to end up giving what amounts to tax advice we’re not qualified to give!)

What is “income” for a corporate “applicant”? Beats me. When in doubt don’t apply for this discount.

To qualify for Micro Entity status, you’ll need to certify that your “gross income” is below a certain threshold. Which makes you responsible for knowing exactly what that means, and I’ll always tell you to consult your tax attorney if you have any doubt.

It’s Not Just Income, It’s “Experience”

It’s not enough to have limited income. You also have to have a limited history in the patent world.

The “experience” limitation means that you can’t have already filed more than four patent applications. Provisionals don’t count toward this limit, nor do international applications.

Also excluded are patent applications filed under prior employment, as long as the employee really had no ownership of the patent rights, which is the usual arrangement in corporate America. If it was a borderline case of a small company that you had some ownership and control of, then you’ll need to get some legal advice that will likely cost more than the discount on what the patent fees is worth.

Joint Inventors Complicate the Picture

So far, I’ve been writing about whether “you” qualify as a Micro Entity. That applies when you’re a sole inventor. However, when there are joint inventors, each inventor must certify he qualifies as a Micro Entity. And if there’s a small business that owns the patent rights (maybe a partnership or any business that employs inventors) the gross income of the business must meet the income threshold. I assume that gross business income is something akin to profits, and not revenues, but if you’re in doubt ask your accountant what those words mean when Congress puts them into a federal law.

If your patent rights are ever assigned or licensed to an entity that isn’t a Micro Entity, then you no longer qualify as a Micro Entity going forward for that patent. Which raises the important point that your qualification can change over time, as your income fluctuates, as your patent licenses might be arranged, and as your experience as an inventor changes. When you become a Micro Entity, you file the certification. When you stop being a Micro Entity, you must file (or hire your attorney to file) a notice that you have lost your status (simply paying the higher fee isn’t adequate).

Tap-dancing in a Minefield?

There are lots of interesting scenarios. Imagine an inventor who files his first four patent applications, and has low income the whole time. Time passes, and he has some maintenance fees coming due on all four. Let’s say it’s 11.5 years later, and he’s paying the big fee of $1850 each, as a Micro Entity. That’s a steep $7400 bill. But suppose he files another patent application just before paying the fees. His Maintenance fee for the original four patents bill doubles to $14,800! So he’d be wise to defer filing until after the big fees are paid.

This shows how just because a patent application was filed by a Micro Entity, it might not always be correct to pay Micro Entity fees for the life of the patent. And if income drops (say, in retirement) you might be pleased to be able to get the discount when the maintenance fees get fat.

Micro Entity status is risky to claim if you’re uncertain about whether you qualify, because if you get it wrong, then proceed to enforce your patent rights in a lawsuit, you can end up having your patent invalidated for your false certification. The law is so new that this hasn’t yet occurred that I’m aware of, but you don’t want to take the risk of losing your investment to save a little in fees.

The law does provide an escape for innocent errors, but if a Micro-Entity patent is ever litigated, count on added days of deposition and trial to challenge the issue.

I must note that most of the investment in getting a patent is in the attorney fees, not Patent Office fees, which are small by comparison. The exceptions are the maintenance fees (due at 3.5, 7.5, and 11.5 years after the patent is granted). These fees total $6300 over the life of the patent (for small entities) and this is cut in half for Micro Entities, so it’s tempting to try to qualify.

My Advice Is: When in Doubt, Pay the Higher Fees!

The total fees for filing a patent application, through its issuance as a patent are just over $1200 for a Small Entity. So there’s only about $600 at stake for those who qualify as a Micro Entity. If you’re dead certain that every inventor and the company applying have less than $150,000 or so gross income, and that no inventor has more than four prior patent applications (even unsuccessful ones that never became a patent) then you might just go for it.

The law allows your attorney to certify on your behalf, but I’m so nervous about being responsible for an error invalidating a client’s patent that I insist on having the client sign the certification at each fee payment stage.

Putting my Money Where my Mouth Is

With my firm’s popular flat-fee provisional patent application filing deal, the filing fee is included, that means that I personally pay thousands and thousands of dollars in patent fees for those filings. Many of them are qualified as micro-entities, but I don’t even bother asking – we just pay the undiscounted fee. That’s because the $65 difference isn’t worth our time and trouble to investigate and fill out the paperwork, let alone the risk of making an error. When the fees get bigger it can be worth the effort.

Can You Trust Your Employees to Get It Right, EVERY TIME?

Here’s a little scenario that should strike fear into the hearts of companies that have employee inventors: Imagine your key employee creates the “crown jewel” invention that represents the bulk of the value of your company. Now, you know you pay him less than $150,000 per year in salary, and your company has less than $150,000 in gross income, so maybe it’s worth seeing about getting discounted patent fees. So you have him read over and sign the certification form. But I worry about several scenarios:

- He signs without reading, and wasn’t qualified.

- He sorta knows he isn’t qualified but feels pressured to sign to get you reduced fees.

- He thinks he’s qualified, but forgot about some income that will end up being revealed in your future patent litigation.

- He’s qualified according to your accountant’s diligent review of the employee’s tax filings, but it turns out that your employee cheats on his taxes.

Are you sure you want to bet your company on this kind of uncertainty, just to get some patent fees reduced?

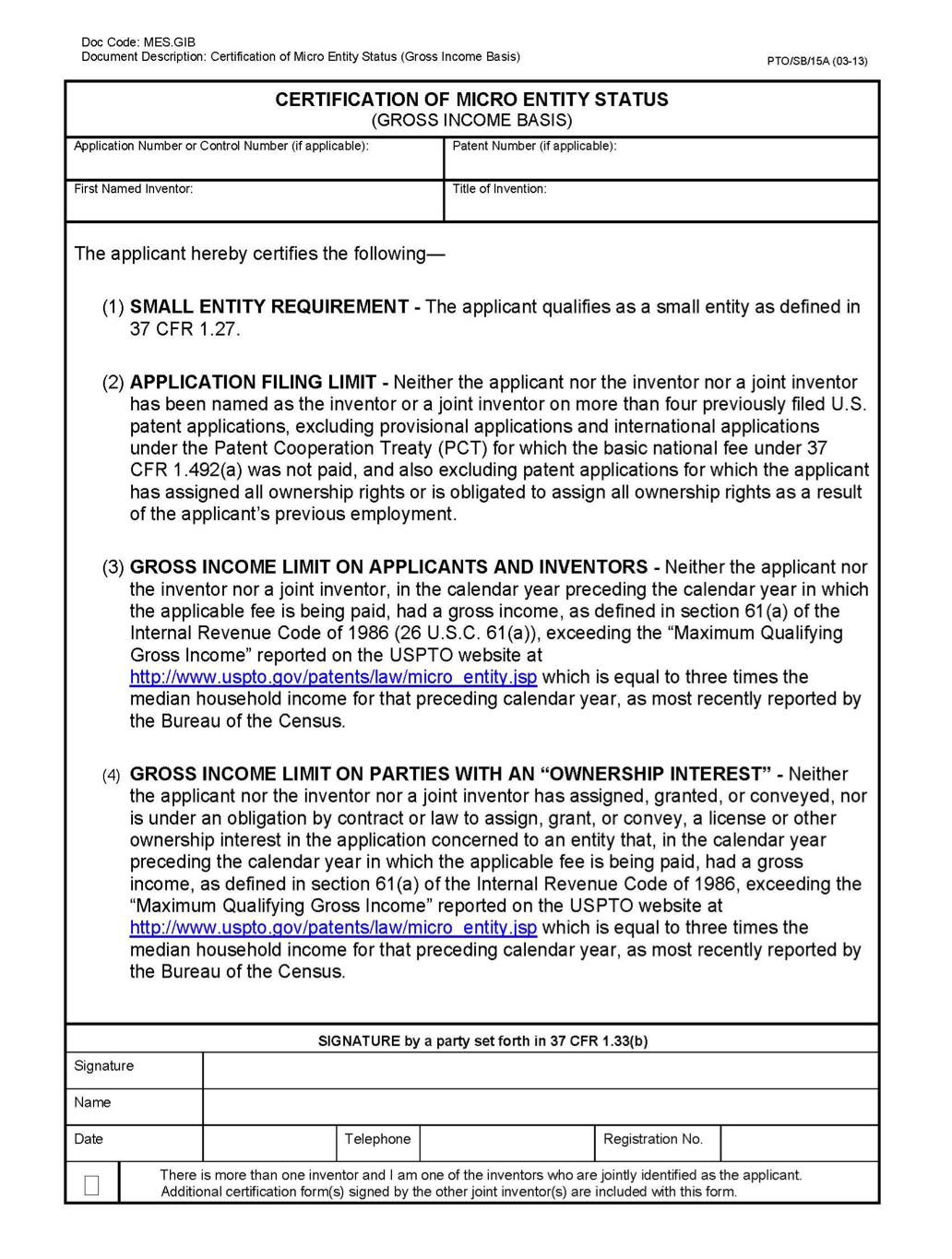

Here’s the Official U.S. Patent and Trademark Office form:

Below is the certification that each inventor, and the company owner, must sign. It is preceded by the following disclaimer that each inventor and owner/applicant must sign.

Acknowledgment of Warnings and

Consent to Filing for Reduced Patent Fees as Micro Entity

(Initial each paragraph)

____ I understand that I am advised by my patent attorney against certifying as Micro Entity if there is any uncertainty about my qualifications or the qualifications of any co-inventor or owner/applicant/employer/licensee.

____ I understand that incorrect certification can invalidate the patent, and that even innocent mistakes of fact and misunderstandings of the rules can invalidate patent rights.

____ I understand that I am responsible for verifying with a financial professional that my individual gross income (if an inventor) or my gross business income (if a business applicant) is below the threshold, and that my patent attorney is unable to advise on whether I meet the threshold or what constitutes “gross income.”

____ I understand that it is inadvisable for joint inventors or for a company employing inventors to seek Micro Entity status, because anyone who has a financial interest in the patent rights should diligently verify the income and other qualifications of all other co-inventors and owner/applicants.

____ I understand that I and all other inventors and owner/applicants are each responsible for notifying the patent attorney of income increases.

____ I understand that the income threshold may change up or down over time, and that even if my income does not change that a patent may be invalidated if I was close to the threshold.

____ I understand that as future fees arise, the patent attorney may opt to file on my behalf as a Small Entity (higher fees) if a current certification from all needed parties cannot be timely obtained.

____ I understand that if permission is given to another entity to operate under the patent, whether or not the permission is formal or informal, with or without compensation, if that other entity does not also qualify as a Micro Entity then this Micro Entity status is lost, and I am responsible for notifying the patent attorney so that the decertification can be made, and future fees be properly paid.

_____ I understand that if I claim Micro Entity status that in the event my patent is litigated (or valued in the due diligence process in a sale of assets) that the tax records of every inventor and every associated company will probably be required to be produced.

_____ I understand that Micro Entity status is unavailable if any inventor has applied for four or more patents (excluding provisional applications) and that if any inventor eventually applies for a fourth patent that Micro Entity status is then unavailable for any and all applications and patents including that inventor.

Signed,

____________________________________

If you’re willing to bet your patent on getting your financial details and patent history just right, then don’t hesitate to ask me about your specific circumstances.